MERGERS AND ACQUSITIONS BASICS

Outline

Summary of this Article

Mergers and acquisitions (M&A) are transactions where the ownership of a company is transferred to or combined with another entity. This can be a type of “exit” for the present owners of the organization as they can sell out and leave the organization.

The structure of these deals falls under three categories: asset sale, stock sale, merger (three types: direct/forward, forward triangular, and reverse triangular). For primarily smaller deals and for tax reasons, targets prefer a stock sale and acquirers prefer an asset sale.

However, the favourite mechanism is the reverse triangular merger because (1) target still has the same legal status which helps in continuity for contracts, etc. (2) can squeeze out minority shareholders (3) easier for consent.

All of these deal structures have different requirements, different issues, different consequences and what structure is being used depends on negotiating power of the parties, and peculiars of the companies/transaction.

What are Mergers and Acquisitions (M&A)?

Mergers and acquisitions (M&A) are transactions where a company or its assets are transferred to or combined with another entity and is a corporate consolidation. It is a type of "exit" event for many individuals/equity holders of the company as they are able to exit or reduce their position, control, etc. It is essentially the end-game, hopefully in a good way, for individuals associated with the company.

This is different from an initial public offering (IPO) where an entity offers to sell its securities (e.g., stock) to the public.

Why do M&A deals happen?

There are three primary reasons for M&A deals:

(1) it can provide for liquidity to current owners;

(2) it can be beneficial from a business development standpoint; and

(3) it allows for an exit for those that want to exit the project for various reasons.

Most frequently the reason companies want to be sold is for a payout to equity owners of the company such as the founders that have equity and investors. At some point or other investors want a return on their investment. And this is how they get that return.

For many entrepreneurs, though not all, having an M&A event for their company after years of working on their project is a primary goal. From there it’s a mish-mash. Some entrepreneurs go on to eventually start a new company and they like that fresh start; others just flat out retire if the payout was sufficient; some others go to the other side of the table and become an investor or advisor; it all depends on what the person wants to do after they’ve completed a large project of operating a company, and maybe just happen to be flush with cash as well.

How do M&A deals happen?

So now you know what M&A is, why these transactions happen, and why anyone would do this. The next question is going to be: “well, how the hell is any of this actually done?”

The following is an order of events for an M&A transaction.

How do M&A deals happen? > Pre-game

The pre-game for a M&A deal is all of the stuff that happens before the transaction is actually consummated. Keep in mind, companies that are to be merged or acquired have gone through all of the different phases listed on the side panel (company formation, company growth and operations, and company financing).

Investment Bank Engagement

So where do you start with all of this? Let’s say that you have a company, and your company has been operating as is, etc. What do you do?

You engage an investment banker.

That’s what you do at this stage. An investment banker will help you understand what the company is worth and help make appropriate connections. After all, if you want to sell a company, you need to have some parties that want to buy the company.

You’ll also need to know how much the company is worth. You need to know the FMV (fair market value) of your company. Well, what in the world is FMV of the company?

That’s a good question.

The Fair Market Value is the value that a willing buyer and willing seller agree for the sale of an asset with certain assumptions such as parties being knowledgeable, not behaving under duress, and other reasonability.

So what does all of that mean?

It means that the fair market value is the fair market value.

There are all sorts of metrics, formulas, this and that for determining FMV. But the actually FMV just comes down to what someone is willing to pay for something.

So there is actually a lot of art to all of this.

In the meanwhile FMV can be a very vague concept.

You can go to conferences and hear what people are saying about how much your company is worth just as a gauge. And while it is helpful to have a rough idea of what kind of value the company has, an investment banker will go beyond just you getting a feel for your company’s value in the marketplace. This is what the investment banker will do. An investment bank helps out with the financials and other aspects of the transaction. It is extremely valuable to have this type of engagement.

Early Documentation

As part of the pre-game portion of an M&A transaction, you will need certain documentation.

These are items that an attorney and investment banker assist with.

o Redacted Acquisition Profile – this is a summarized version of the Confidential Information Memorandum (see below)

o Non-Disclosure Agreement – you know what this is. An M&A deal is going to involve highly sensitive corporate, financial, and other information. This document helps protect confidential information from one group (here the target) from being misused or inappropriately disclosed by the recipient of the information.

o Confidential Information Memorandum – known by many other names such as Offering Memorandum, Information Memorandum, etc.

This document has a lot of information on the company.

It is a profile on the company, what it does, has financial information, and other important items. This document is considered a preliminary due diligence item.

Due diligence is a term that you will see keep popping up.

Due diligence is the investigation and review of the deal and company details in order to match representations and warranties made. This preliminary due diligence is part 1 of 2 types of due diligence. I will touch on the second part later in this article.

How do M&A deals happen? > Mid-Game

Letter of Intent

The letter of intent is a letter from the acquirer to target with a summary of terms for the proposed transaction. Various items of the proposed transaction are negotiated at this stage.

Even if the letter looks simple it is important for a lawyer to look at this. The terms in the letter of intent are the primary terms of the deal and thusly have substantial impact on everything. A process of “red-lining” will happen between the target lawyer and the acquirer lawyer where items in the letter are changed, negotiated, etc. And if something non-binding is “agreed” to here, it will be difficult to change later as you will get substantial push-back.

Furthermore, keep in mind this: target has the most negotiation power in the transaction at this stage in the game. Overtime that negotiation power will significantly lessen. Therefore, it is important for target to address particular items of concern at the letter of intent stage.

o Letter Form

A letter format is traditionally used for the M&A transaction proposal. And this will come from acquirer. However, sometimes the letter of intent may take the form of a Memorandum of Understanding (MOU), term-sheet, or a similar item. These items come out to basically the same thing: a summary of the proposed transaction.

o Binding/Non-Binding

The binding nature of these letters of intent are an often discussed topic in contract law circles. In general, the letter of intent is considered to be largely non-binding with a few provisions that are binding. Which is what should be clearly labeled in the letter. You should know which section is which typically with bold, capitalized font.

o Parties

Unfortunately, “party” here does not mean a fun get-together. That can come after everything is done. The letter will state the name and identify the parties (who is the acquirer, etc.) A placeholder for acquirer may be used. For example, a to-be-named acquirer affiliate or subsidiary may be the actual party. It is normal for the acquirer party name to be changed at the time of closing of the deal. It is not problematic in and of itself if that occurs.

o Deal Structure Type

The deal structure (e.g., asset purchase acquisition, stock purchase acquisition, merger) is one of the most important terms in an M&A deal. Stock purchase acquisitions are more advantageous to the target for tax and other reasons than an asset purchase acquisition; however, the go-to M&A transaction is the reverse triangular merger. More on all of this below.

o Purchase Price/Consideration

The letter of intent will spell out the purchase price/consideration for the transaction. Every contract needs consideration to be binding. It’s the thing that is of value that is being exchanged. This often means cash but can mean stock, etc.

This section in the LOI will also describe how the purchase price will be paid out (if there is a holdback amount, etc.)

o Indemnification

Indemnification is a legal concept where the “indemnifier” agrees to cover losses or damages of the “indemnitee” party. You will see this indemnification concept in all sorts of contracts. In the M&A context, contractual arrangements are made such that certain parties must indemnify the acquirer in the case of losses (for example, a representation in the contract was incorrect resulting in damages or some kind of breach of contract).

The total amount that is subject for indemnification is the holdback portion amount of the purchase price. More on this below.

One important note is that it is possible that certain owners of the target company that are indemnifying the acquirer. In such a scenario it is important that the owners are not jointly and severally liable to the acquirer (where each can be responsible for the full amount.)

o Due Diligence Access

The acquirer will list out the terms for the process of due diligence in the letter of intent. This means that acquirer may, for example, request data room access to analyze and confirm data about the company including financial data, contracts and agreements, employee and worker data, etc.

The length of due diligence should be spelled out here. Additionally important are terms that there should be a reasonability for the due diligence process and that acquirer should not disturb target during this process.

o Exclusivity

You can’t be dating multiple parties at once at this stage. You can do that in the pre-game. But once things start to become serious the target should not be shopping around for other deals. At least not for 90 days or so. The LOI will spell out the exclusivity timeline and details.

o Conduct of business (ordinary course – no extraordinary transactions)

Acquirer will seek to ensure that the target operates in the ordinary course of business. It’s important no extraordinary transactions are done by the target. The primary purpose of this is because acquirer wants to buy the target in the manner the target operates and does not want anything to happen that can cause a drastic shake-up. Acquirer does not want the structure of the target to drastically change or for the target to engage in an extraordinary deal that has a significant impact on the value of the target.

o Disclosure to Others/Third-parties

A lot of the dealings at this stage are hush-hush for obvious reasons. Among other things, you don’t want a situation where those that don’t need to know about the deal get wind of it and that has an impact on deal value. Public commentary gets disallowed for a certain time frame here. Disclosure is generally limited to owners, officers, directors, and when required by law. If a certain disclosure is required by law it is not uncommon that the other party (acquirer/target) must be informed of such disclosure.

o Signature

The appropriate acquirer and target executives will sign the letter of intent. One item to be careful about here is that an acquirer will often put an absurdly quick deadline for signing the letter. This type of deadline is used in many areas (e.g., settlement offers). Don’t fret about the deadline. Do the appropriate analysis of the letter with your attorney and sign when ready. Don’t be pushed around.

How do M&A deals happen? > Mid-Game

Principal Agreement

The principal agreement will be the asset purchase agreement, stock purchase agreement, or merger agreement. It is the main document for the transaction. It will have all of the terms, conditions, of the deal including exhibits listing assets in the deal, etc. depending on the type of deal. This principal agreement gets executed (signed) by the parties with a closing date some time out (e.g. 90 days).

The principal agreement will have all of the components of any well-drafted contract including proper identification of parties, recitals (basic background information on the contract), definitions for certain terms, exhibits, due diligence terms, the type of deal structure, purchase price/consideration terms to be paid and terms of such, representations and warranties (statements of current facts and the future), any covenants (promises), and proper signature blocks.

As mentioned, the LOI will be the framework for what the principal agreement will look like. So the terms in the LOI (explained above) will be expanded and detailed here in a more robust manner.

An item in the principal agreement may be expanded in a manner that is not a reasonable interpretation of what was mentioned in the LOI. In such a scenario expect or give pushback.

Primary Due Diligence

Due diligence can be thought of as being in two parts. The first is preliminary due diligence. It is discussed above. That is the part that comes before the principal agreement is signed. Preliminary due diligence information concerns basic legal and operational information about the company and is provided in the “early documents” of the deal including the Redacted Acquisition Profile and the Confidential Information Memorandum.

Primary due diligence comes after the principal agreement is signed.

This is the second or primary part of due diligence and is done as according to the terms of the principal agreement. While preliminary due diligence takes place during the pre-game phase primary due diligence will take place during the mid-game and conclude before closing. The principal agreement will contain a list of all of the items that need to be part of the due diligence process. This includes financial data, legal data, operational data, contracts of the company, etc. All of this goes into a data room with restricted access. As you recall, due diligence is the analysis, review, and confirmation of target company contracts, history, financial data, personnel information, and other details. This information needs to match the information provided in the representations and warranties made in the principal agreement. The data room, often in digital form and with restricted access, is important for this process particularly in more complicated deals. As part of due diligence, acquirer team may also visit target company offices.

Government Filings

Certain M&A transactions need approval from government entities as the government has an interest in promoting commerce and in dealing with antitrust issues, etc. These are known as HSR filings (after the Hart-Scott-Rodino Improvements Act of 1976).

This process can be initiated at the letter of intent (LOI) stage as there is a waiting period.

Voting and Consent

Depending on the type of structure, the transaction will need to be approved by shareholders.

Voting agreements may be secured by acquirer at the time the principal agreement is signed.

How do M&A deals happen? > End-game/Closing

End-game/Closing

At closing, everything gets exchanged and the deal is effectively finished. This means delivery of stock, cash, etc.

Filing

Filing of merger agreement with secretary of state occurs at this point.

How do M&A deals happen? > Post-game

Post-closing Adjustments

The purchase price amount is likely to be subject to certain conditions (such as an “earn-out” or with an amount that is in “escrow” or “holdback”).

Indemnification claims

The topic of indemnification was discussed earlier. Any claims are dealt with.

Company assimilation/integration

An M&A deal can mean a lot of changes in terms of ways of doing things, direction, leadership, etc. It takes time for everything to integrate and transition. A transition services agreement can come into play here where certain personnel are hired by the acquirer to assist in making the change a smooth process.

M&A Deal Structure, Issues, and Other Items

M&A Deal Structure, Issues, and Other Items > Deal Structure

One of the most important technical standpoints from a legal perspective will be the deal structure.

An acquisition is where one company acquires another by purchasing another. This can be done by purchasing: all or substantially all of the assets of the target, all of the equity (e.g. stock of the company), or a majority of equity.

A merger is where companies combine to form a single company, with one entity being the surviving entity and the other (target) company transferring its assets and liabilities to the surviving company and dissolving as an operation of law.

The structure of these deals further falls under the following categories—for acquisitions: asset sale and stock sale; and for mergers: direct/forward, forward triangular, and reverse triangular.

The type of structure used has company structural and tax consequences. These all have different requirements, different issues, different consequences and what structure is being used depends on negotiating power of the parties, and peculiars of the companies/transaction

For primarily smaller deals and for tax reasons, targets prefer a stock sale and acquirers prefer an asset sale.

However, the favourite mechanism is the reverse triangular merger because (1) target still has the same legal status which helps in continuity for contracts, etc. (2) can squeeze out minority shareholders (3) easier for consent.

DEAL STRUCTURE > ASSET PURCHASE ACQUISITION

An asset is any resource owned or controlled by the entity and anything that can be used to produce positive value; it represents ownership of something of value that can be converted into cash.

In an asset deal, the acquirer purchases all or substantially all of the assets of the target. It will additionally assume some or all of its liabilities.

Essentially, an asset deal is acquirer-favorable. Aside from a tax benefit, the acquirer gets to buy components of the company that will be beneficial to acquirer and disregard the parts that are not, including disregarding certain items that have a liability risk attached. The acquirer gets to go out and cherry-pick.

An asset deal is not as common as other M&A deal structures.

Here’s what’s happening here. Two entities exist: target and acquirer. In an asset M&A deal, the acquirer will acquire the assets and liabilities from the target and the target will receive consideration in return (that which is being exchanged; for example, cash) (more on consideration below).

Two companies exist: target and acquirer. The target will still exist and as appropriate wind-down the company. For the shareholders of target to get paid out on this deal, there would need to be a distribution from the company to the shareholders (which would result in two layers of tax).

Deal Structure > Asset Purchase Acquisition > All or Substantially All of the Assets

One of the considerations for asset deal is whether or not the deal was for all or substantially all of the assets of the company. The difference between selling an asset or two versus all or substantially all of the assets of the company comes into play with shareholder consent and tax—where a company would need the latter for a sale of all or substantially all of the assets. Whether or not a sale for assets is all or substantially all of the assets is not a strict-line test. Various courts have different ways of approaching this issue including the Gimbel test. The Gimbel test has two parts: a quantitative test and a qualitative test. The qualitative approach focuses on items like cashflow generated by the assets, whether it was out of the ordinary, and was at the heart of the corporate existence and purpose; and the quantitative approach looks at the overall effect of the company of the transaction.

All or substantially all of the assets also comes into play regarding tax and this is a requirement for tax-free reorganizations.

Deal Structure > Asset Purchase Acquisition > Tax Issues

For a tax-free acquisition the transaction must be for the acquiring of substantially all of the target company’s assets. If not, then the acquisition will be taxable to the target’s shareholders. The IRS has dictated on what substantially all means—which is 90% of the net assets or 70% of the gross assets.

The acquirer and target allocate the purchase price across the assets and assign a value to each one (sometimes assets are grouped together into similar groups). This can be allocated in a tax-optimal way for the acquirer.

Deal Structure > Asset Purchase Acquisition > Anti-assignment

Assignment is one of those clauses that you often see at the bottom of a contract near the miscellaneous items. Most of the time, this is an item that people do not strongly think about or consider.

So what is an anti-assignment clause?

First you have to understand what is assignment in a contract.

Assignment is a legal concept that allows one party to transfer (assign) their rights, responsibilities, etc. to another party. So let’s say you hire someone to cut your lawn. That person can assign the contract to another party. There are some subtleties to this and times that assignments cannot be enforced, but that’s generally how it works.

An anti-assignment clause in a contract says that the contract cannot be assigned.

What does this have to do with asset deals?

In an asset deal, contracts are often part of all of this. An ant-assignment clause in a contract states that the contract cannot be assigned without the non-assigning party’s consent.

I have had to spend a great deal of time looking at every contract of a company in an asset deal and check the anti-assignment provision of each contract. These contracts are all in the dataroom for analysis. If there’s an anti-assignment provision, then consent will be needed. This is usually not a problem, but in some circumstances it can be.

Deal Structure > Asset Purchase Acquisition > Approval and Consents

More scrutiny and more requirements are necessary if the asset transaction is for all or substantially all of the assets of the company. If the company is simply selling some assets, then a board consent would suffice. If the company is selling “all or substantially all” of the assets then it will also need shareholder approval.

Deal Structure > Asset Purchase Acquisition > Bulk-Sales Laws

While these vary from state to state, Texas and Delaware have bulk-sales laws. It is the requirement of target to provide notice of a deal where a large percentage of assets are being transferred before the transaction is completed to give notice of the deal to the target’s creditors.

Deal Structure > Asset Purchase Acquisition > Advantages and Disadvantages of an Asset Transaction

Advantages of an asset deal

Acquirer: asset deal can be tax beneficial to the acquirer

Can obtain a “step-up” in tax basis of acquired assets vs. obtaining the historical or original basis

Acquirer: is more efficient in that it buys only what it wants

Acquirer: can leave behind liabilities it does not want to deal with

Disadvantages of an asset deal

Target: Asset deal is not tax optimal for the target and can result in double taxation for the target (target company is taxed on the gain from asset sale and the shareholders are taxed on the distribution of the net proceeds)

Target: May have items of liability-risk leftover to target

Target: Will still have to go through wind-down process to have the company cease in existence as the company was technically not sold. So this means having to deal with corporate governance, deal with tax issues, consents, etc. You’re still operating the company but there’s no real benefit—it’s just technical stuff.

Acquirer: Acquirer may not purchase important assets that it otherwise should have

Acquirer: May still have to deal with liability issues

DEAL STRUCTURE > STOCK PURCHASE ACQUISITION

An acquisition pursuant to a stock purchase is where a party acquires a target by exchanging consideration for stock of the target. Note that it is the shareholders of the target that have the stock so the transaction is technically between the acquirer and the shareholders of the target, not necessarily the target itself.

Similar to the situation above, even though it is a stock transaction, the consideration (what is using to pay for the stock) may come in a wide variety of forms.

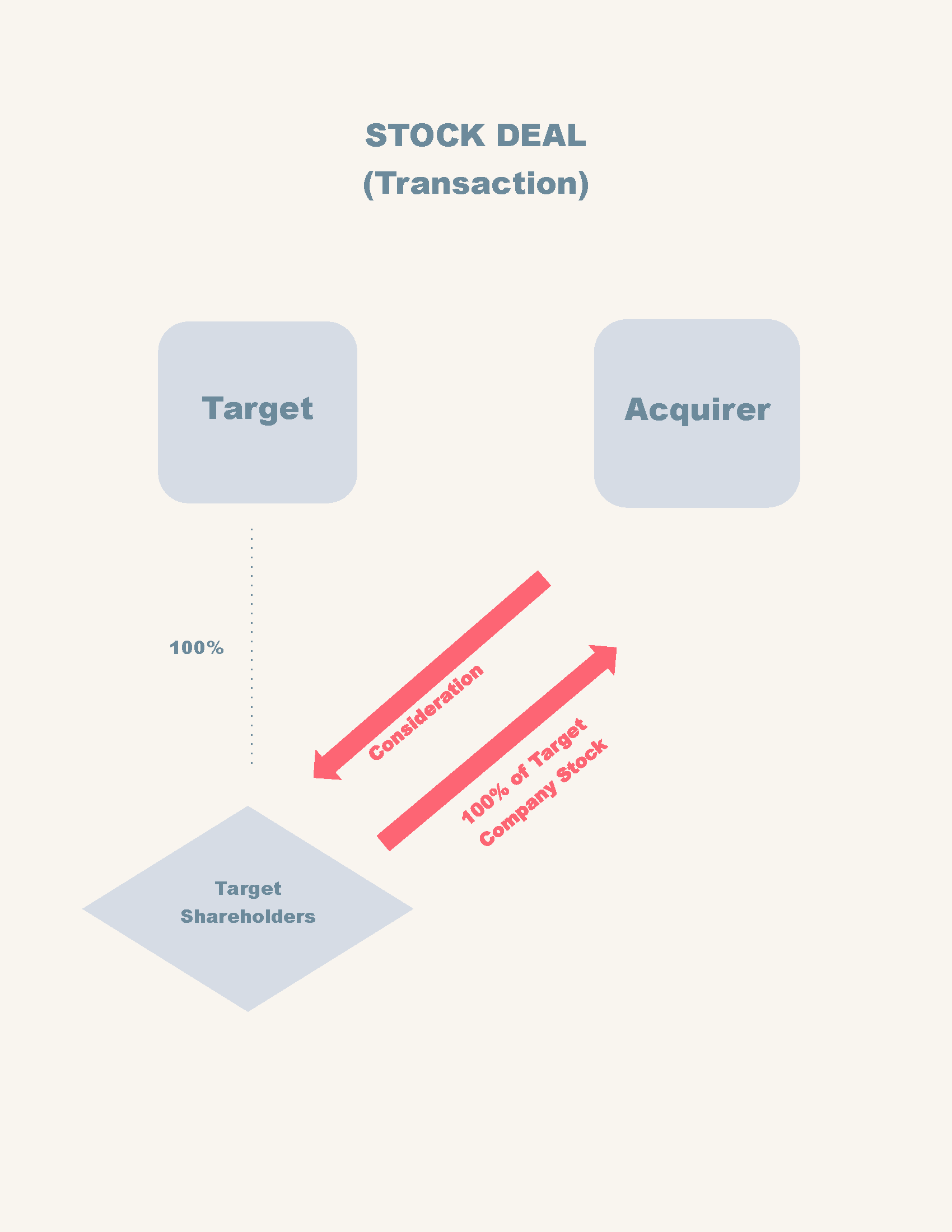

In the stock purchase acquisition transaction Acquirer provides consideration (e.g., cash, acquirer stock) in exchange for target company stock. You can see that the transaction is between the Acquirer and the target shareholders.

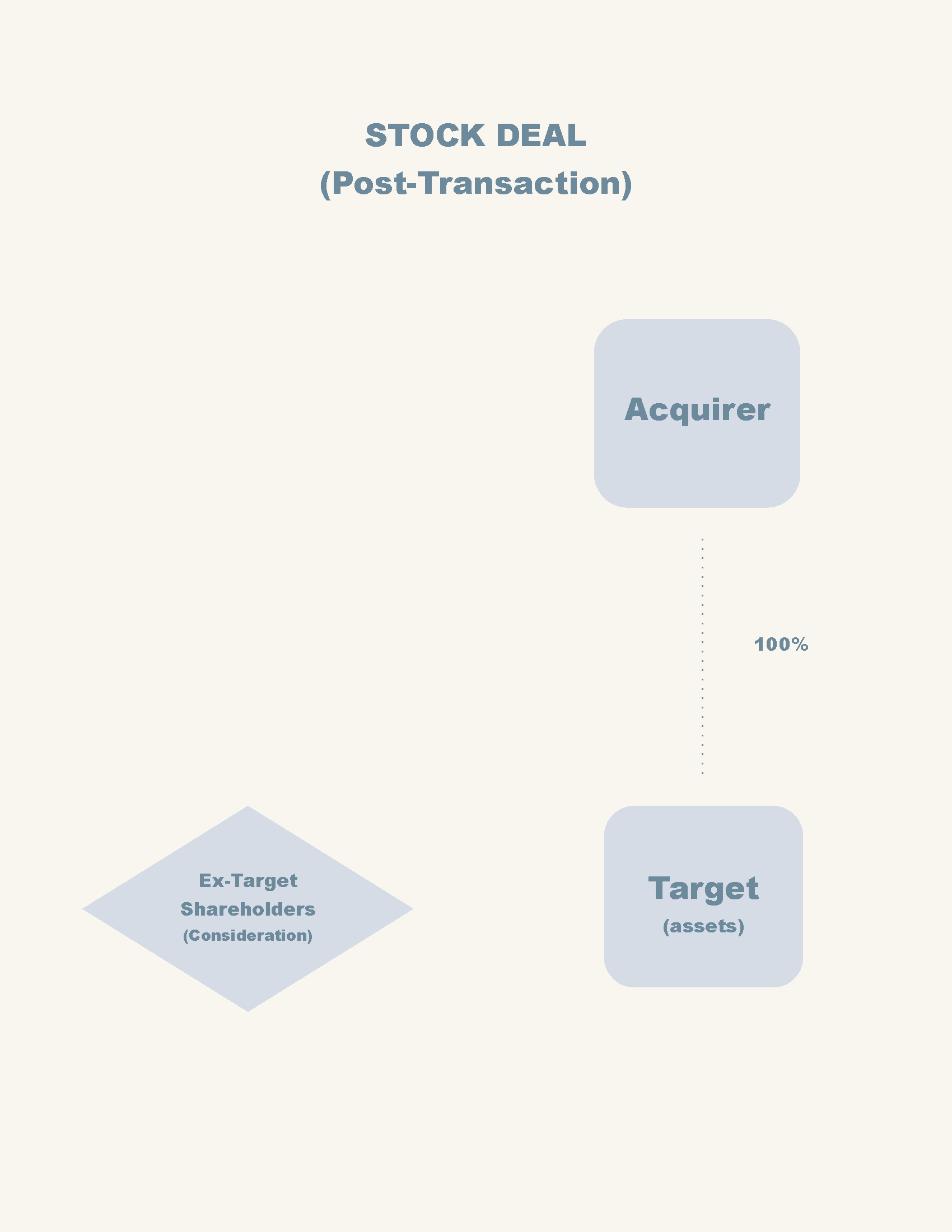

After the stock purchase acquisition for 100% of stock you can see that the ex-target shareholders have no attachment to the target company and that acquirer owns target.

Deal Structure > Stock Purchase Acquisition > Approval and Consents

In order to fully-acquire the target, all target shareholders must consent to selling their stock to acquirer. This can be problematic if there are some holdouts who do not want to sell the company. Straight up stock purchase deals are therefore mostly used when the number of shareholders is small. This is a reason why mergers are often used instead of a stock purchase deal.

Needing approval for assignment from third-parties is not relevant in a stock purchase acquisition because the contracts and agreements with the third-parties and the target company still exist. There is just a change of control of the company, absent a contractual clause that says that a change of control of the company must need approval by a third-party in a contract, third-party consent is not a large concern. One item to be careful about however is looking at the assignment provision and look at how assignment is being defined.

Deal Structure > Stock Purchase Acquisition > Advantages and Disadvantages of a Stock Transaction

Advantages of a Stock Deal

Acquirer: acquirer gets all of the assets of the company and nothing slips through the cracks

Target shareholders: it’s a done and dusted situation. They won’t have assets of the target company but they also don’t have liabilities. They do not have to worry about winding-down the company or similar actions

Target shareholders: only one level of tax (at the shareholder level). This is in contrast to an asset transaction as mentioned above.

Disadvantages of a Stock Deal

Acquirer: receives all of the liabilities

Acquirer, Target: stock purchase requires approval by every target shareholder in order for acquirer to acquire 100% of target

DEAL STRUCTURE > MERGERS

A merger is a type of business combination where a business “combines” into another company and is for legal considered to become one entity.

I’ll go through the different types of mergers here as well as it is important to know that there’s not just one type of merger. Whenever companies in the startup world transact a merger it is generally of the reverse triangular merger variety.

The primary reason why mergers are used is because not all shareholders of the target have to consent.

The three types of mergers:

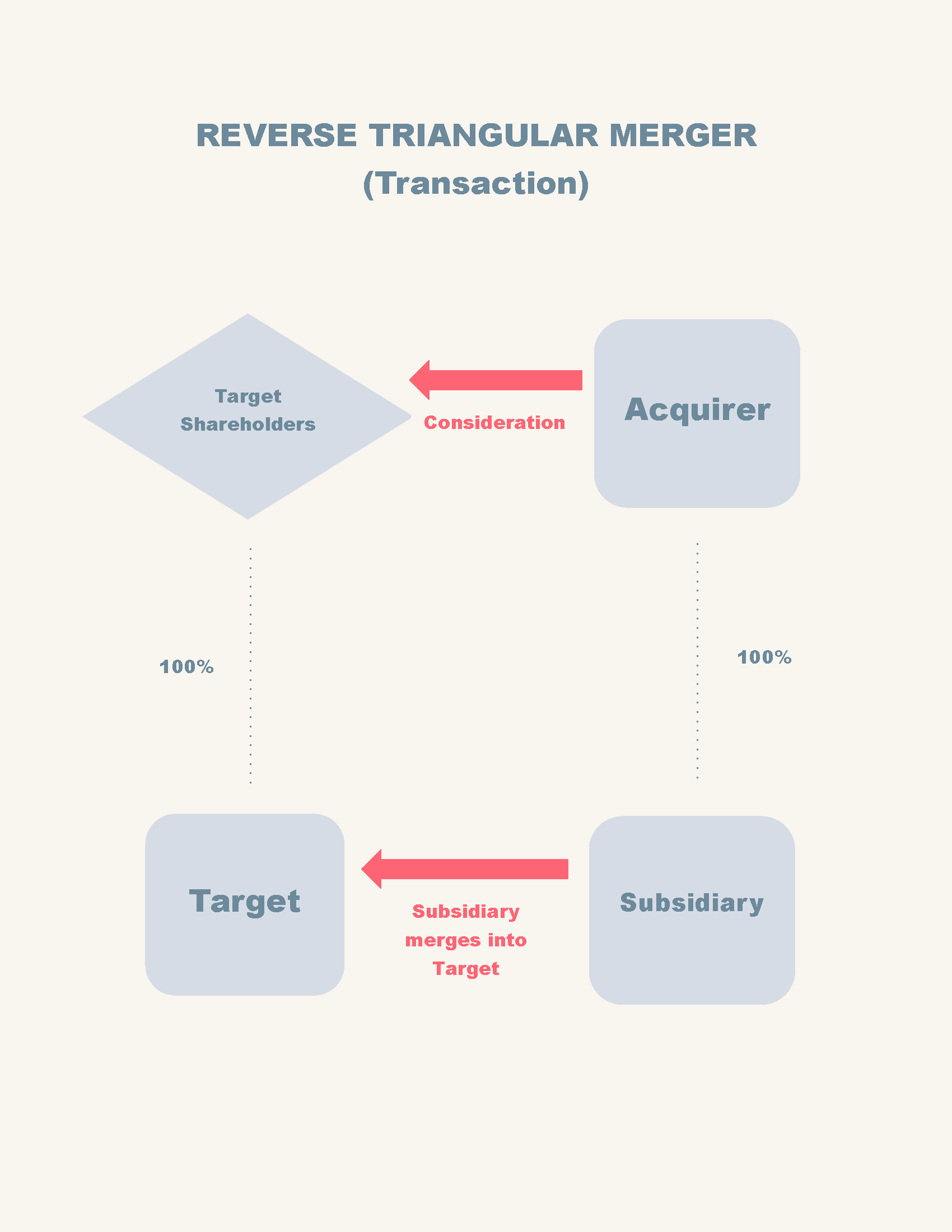

1. Direct or Forward Merger: target company directly mergers into acquirer and target company ceases to exist as a separate entity

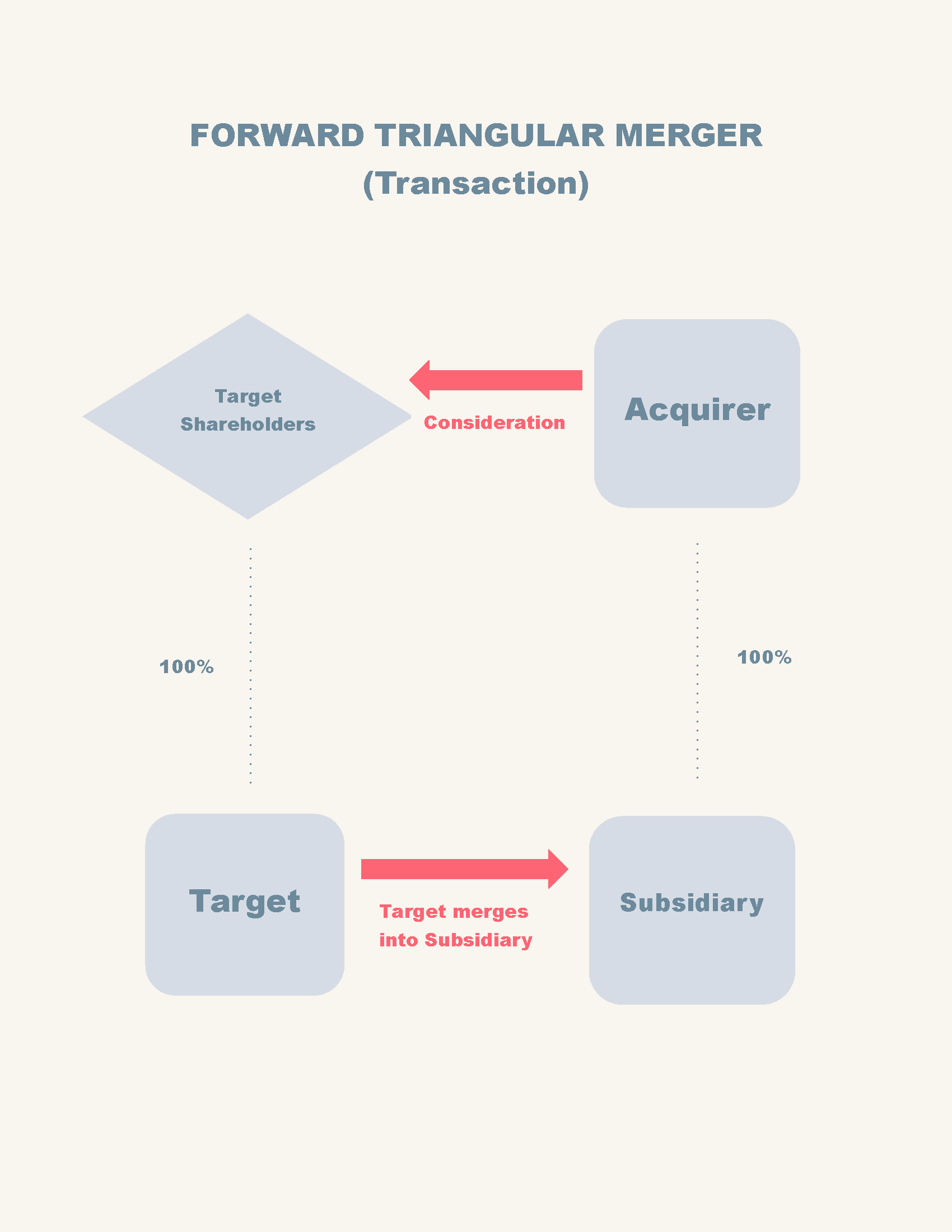

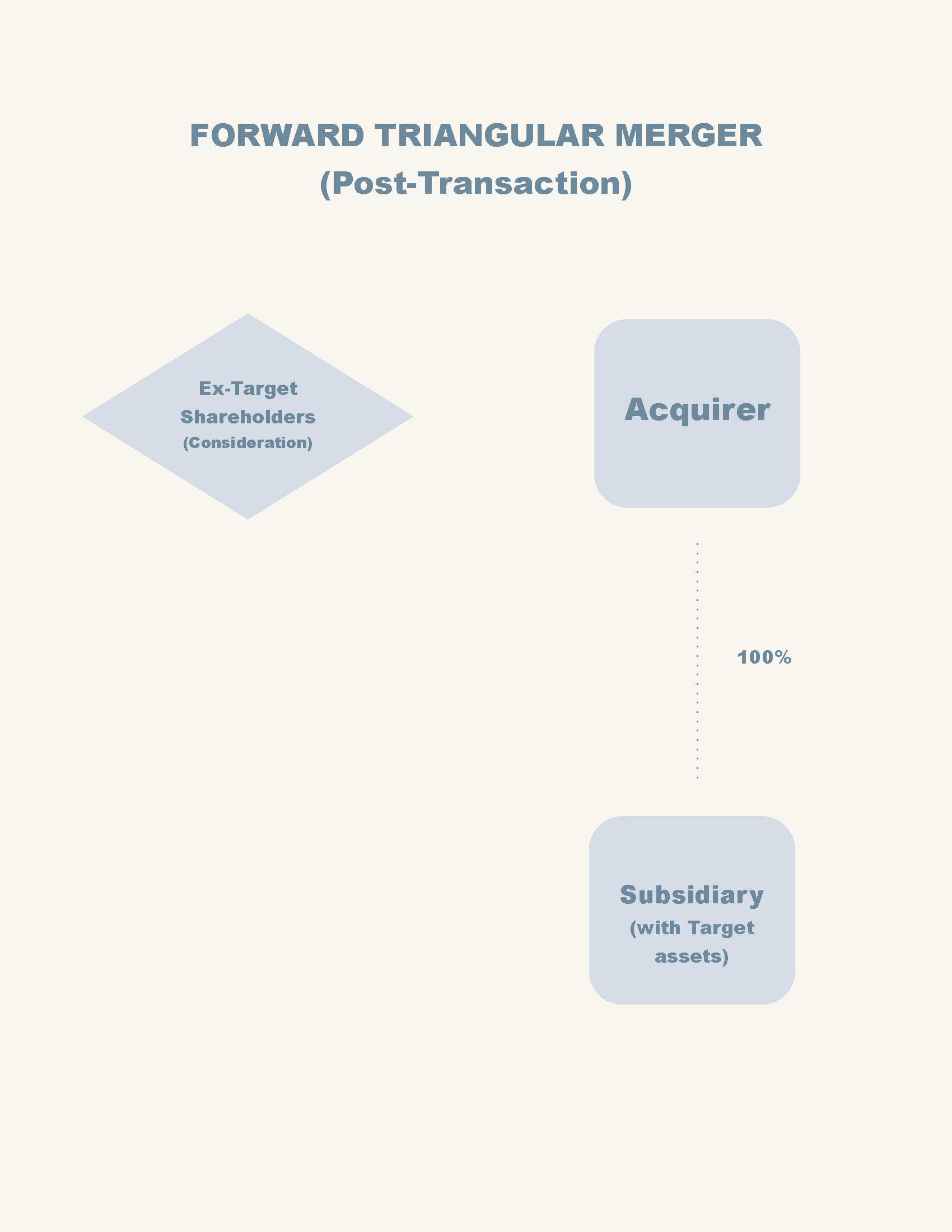

2. Forward Triangular Merger: a subsidiary of the acquirer exists or is created and the target merges into the subsidiary. Subsidiary survives.

3. Reverse Triangular Merger: a subsidiary of the acquirer exists or is created and the subsidiary merges into the target. Target survives and becomes a subsidiary of acquirer.

Deal Structure > Mergers > Direct/Forward Merger

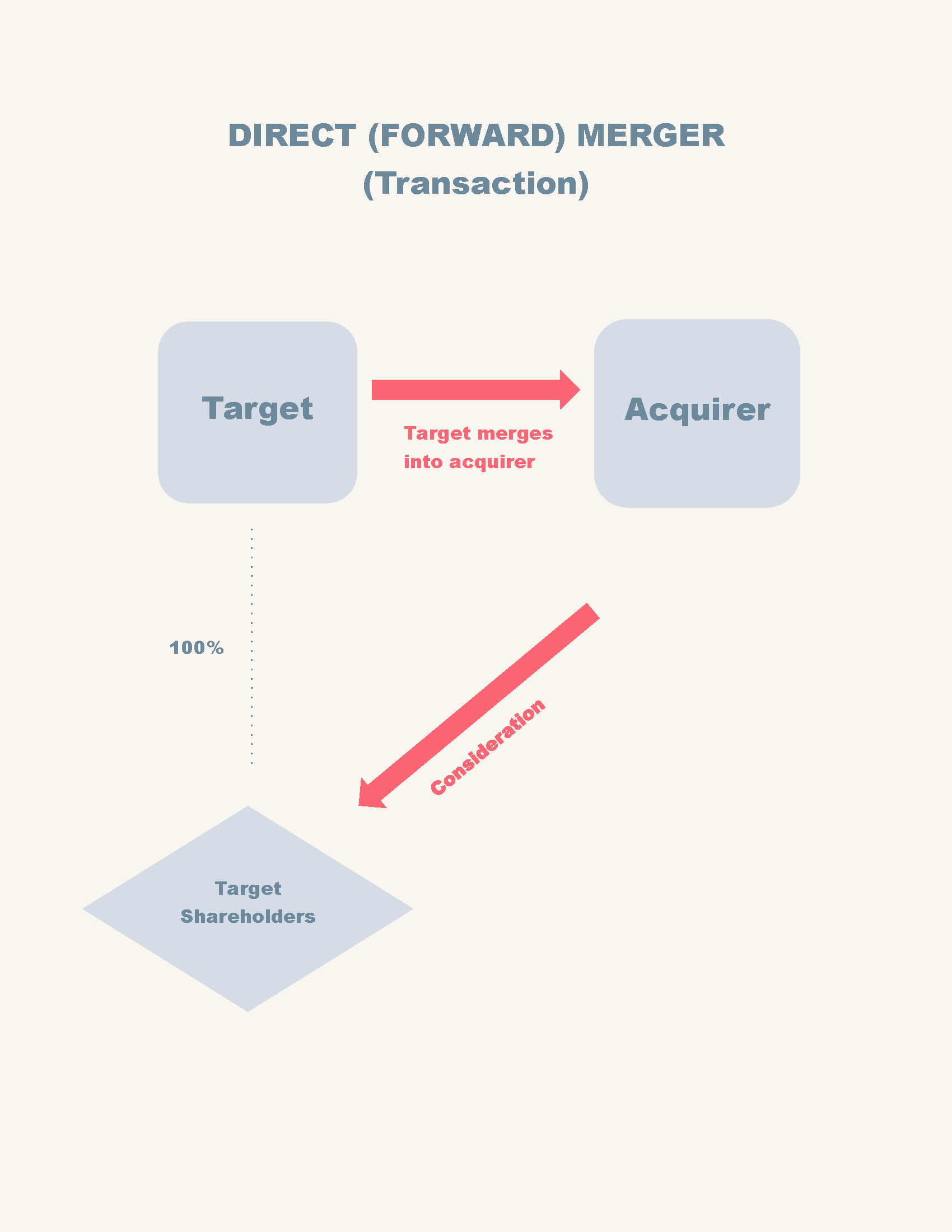

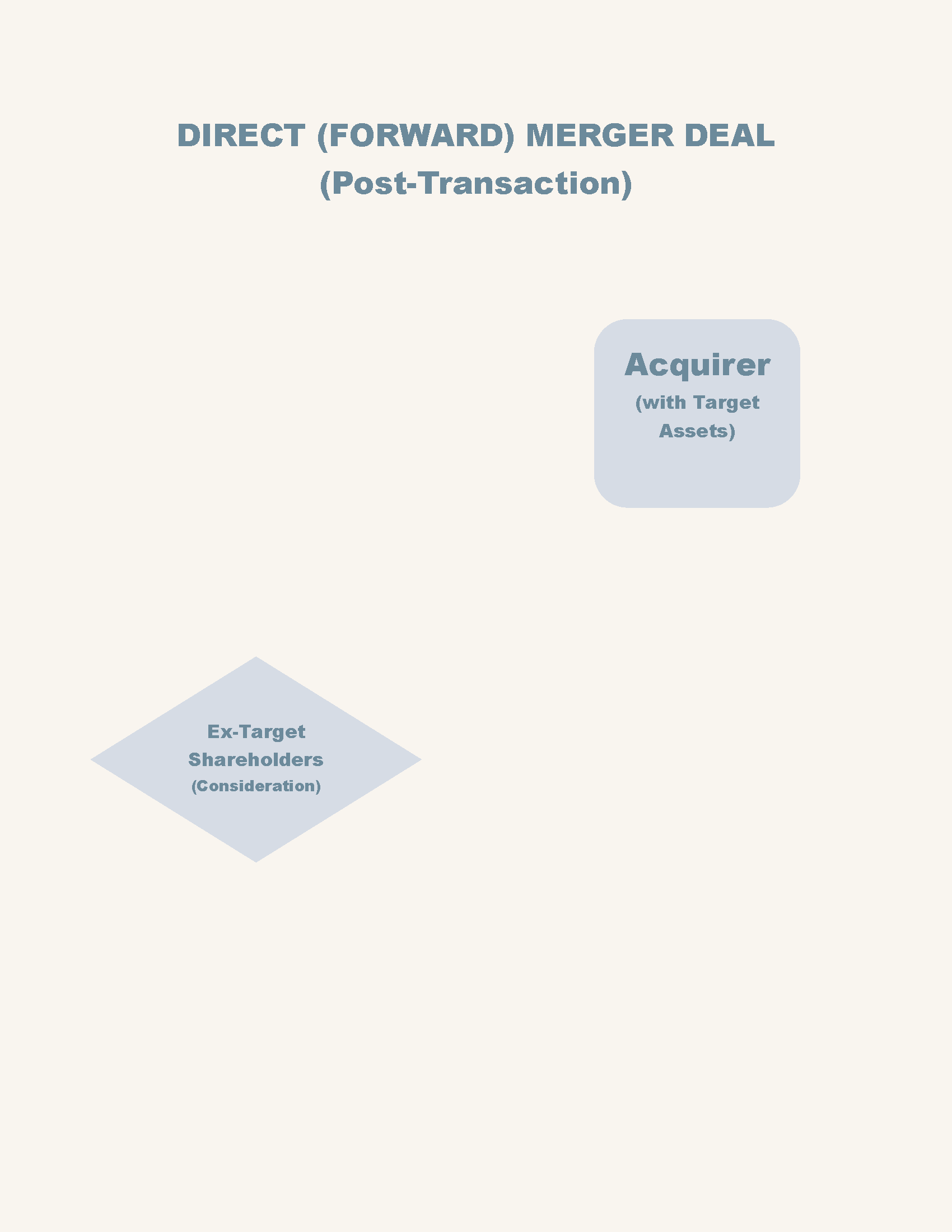

The most straight forward type of merger. Acquirer gives consideration to the shareholders of the target. And the target merges into the acquirer. As a result of this, the acquirer survives and has all of the assets and liabilities of the target; the target as its own separate entity does not exist.

Here you can see consideration going from acquirer to target shareholders and target merging into acquirer.

Deal Structure > Merger > Advantages and Disadvantages of a Direct (Forward) Merger

Advantages of a Direct (Forward) Merger

Acquirer: is able to acquire all assets (no chance of assets that get missed)

Target: transaction is clean and will not have to go through wind-up process

Acquirer: requires the approval of at least a majority of shareholder vote of target to consummate the transaction (instead of a unanimous vote); and then acquire 100% of the target via state merger doctrine

Disadvantages of a Direct (Forward) Merger

Acquirer: acquires, on a direct level, liabilities of the target. Acquirer’s assets are directly exposed to target’s liabilities.

Acquirer: third-party consents will need to be acquired to assign contracts of the target company to the acquiring company

Deal Structure > Mergers > Forward Triangular Merger

This is also a type of merger with similar principles. However, instead of the acquirer and target merging, acquirer has a subsidiary and the target merges into the subsidiary with the subsidiary being the surviving entity.

In the Forward Triangular Merger transaction you can see that the acquirer provides consideration to the target shareholders and the target mergers into a subsidiary of acquirer.

Deal Structure > Merger > Advantages and Disadvantages of a Forward Triangular Merger

Advantages of a Forward Triangular Merger

Acquirer: is able to acquire all assets (no chance of assets that get missed) through a subsidiary

Target: transaction is clean and will not have to go through wind-up process

Acquirer: while acquirer acquires liabilities of the target, it is able to shield it in a subsidiary. Acquirer will not be directly exposed to the target’s liabilities.

Acquirer: may not need to obtain its shareholder consent to the transaction

Acquirer: requires the approval of at least a majority of shareholder vote of target to consummate the transaction (instead of a unanimous vote); and then acquire 100% of the target via state merger doctrine

Disadvantages of a Forward Triangular Merger

Acquirer: third-party consents will need to be acquired to assign contracts of the target company to the acquiring company.

After the forward triangular merger transaction you can see that the former target shareholders hold the consideration, and that subsidiary is the surviving entity and holds target assets/liabilities.

Deal Structure > Mergers > Reverse Triangular Merger

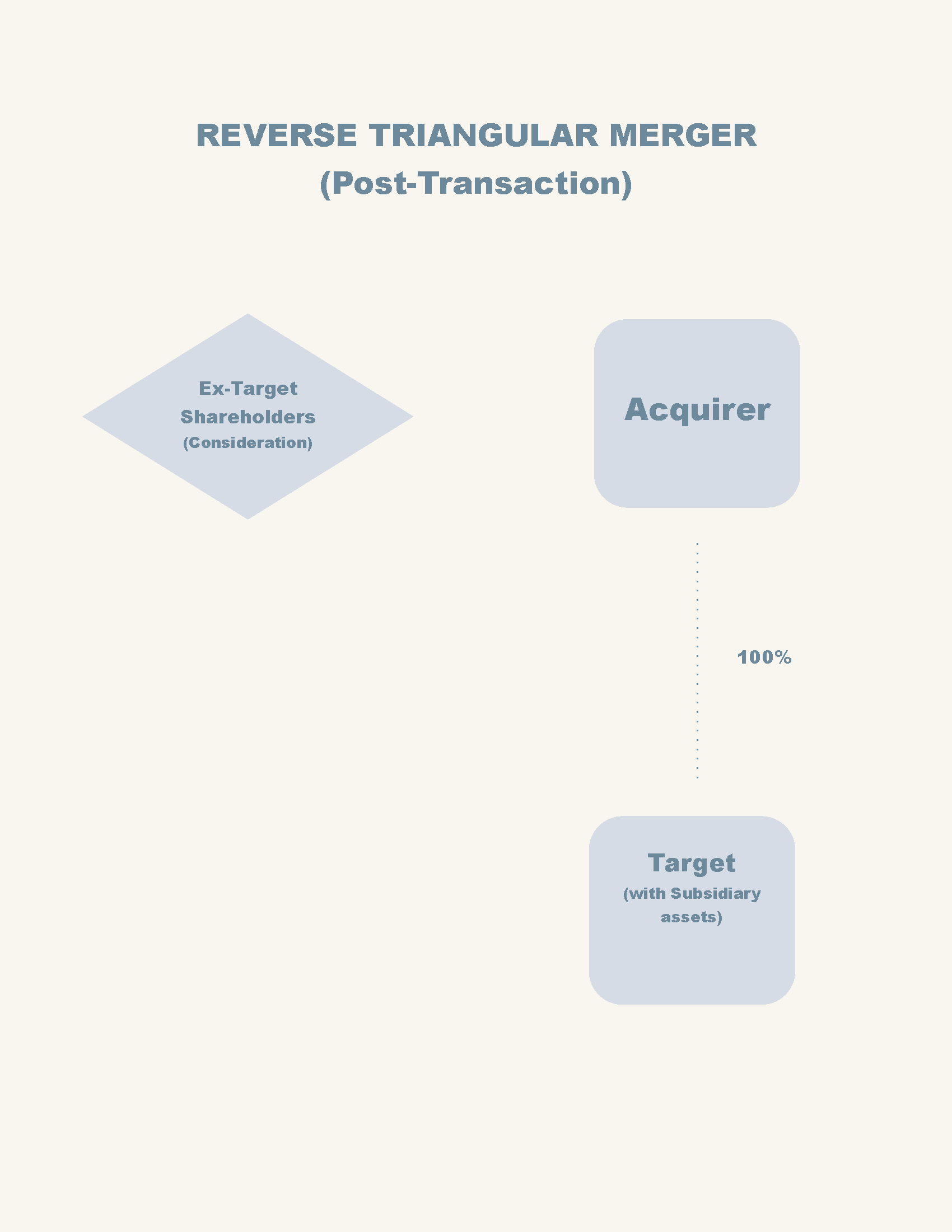

A reverse triangular merger is similar to the forward triangular merger however the subsidiary of acquirer merges into the target and the survivor is the target entity. The target then becomes a fully owned subsidiary of acquirer.

“One of the reasons to pursue reverse cash or triangular merger is the ability to maintain the target company’s legal status, which helps it preserve contracts and other nontransferable assets. Also, the transaction structure makes it easier to squeeze out minority shareholders or cash out options. As a result, the reverse triangular merger is a perennial favorite amongst publicly traded companies.”

In the reverse triangular merger acquirer gives consideration to target shareholders and acquirer’s subsidiary merges into target.

Post reverse triangular merger transaction former target shareholders hold the deal consideration and target is the surviving entity as a subsidiary of acquirer.

Deal Structure > Merger > Advantages and Disadvantages of a Reverse Triangular Merger

Advantages of a Reverse Triangular Merger

Acquirer: is able to acquire all assets (no chance of assets that get missed) through the use of a subsidiary

Target: transaction is clean and will not have to go through wind-up process

Acquirer: while acquirer acquires liabilities of the target, it is able to shield it in a subsidiary. Acquirer will not be directly exposed to the target’s liabilities.

Acquirer: third-party consents will not need to be acquired for purposes of contract assignment as the target company is still in existence.

Acquirer: may not need to obtain its shareholder consent to the transaction

Acquirer: requires the approval of at least a majority of shareholder vote of target to consummate the transaction (instead of a unanimous vote); and then acquire 100% of the target via state merger doctrine

Disadvantages of a Reverse Triangular Merger

Acquirer: third-party consents will need to be acquired to assign contracts of the target company to the acquiring company.

M&A Deal Structure, Issues, and Other Items > Payment

Purchase price, cost, consideration, whatever you want to call it, there needs to be payment to effectuate the M&A transaction.

So that’s what we’re dealing with in this section.

First, let’s quickly address a legal concept called “consideration”.

On a high level, consideration is something of value that each party to a contract provides or promises as an exchange. This is required in order to make a contract legally binding.

In the M&A context this is generally cash, stock, or a combination of cash and stock.

One item that can be a tricky to recognize is that the consideration in the deal can vary. Consideration is that which is being exchanged in a contract. In this context, assets are being purchased and consideration is being used to pay for the assets.

Consideration can come in many forms. It does not have to be straight-up cash. It can also be stock, and other items. So even though the transaction is an asset deal, it is possible that stock is also involved. But it’s being used as consideration by acquirer instead of the item that is being bought by acquirer.

M&A Deal Structure, Issues, and Other Items > Payment > Payment Type

Cash

Cash is cash. It will trigger an immediately taxable consequence. Sometimes the cash payment can be deferred or a promissory note used which is typically unfavorable to acquirer/acquirer stakeholders.

Part-cash/part-stock

This is a mixture of different types of consideration. When dealing with stock as consideration, special care must be given as the stock can change in price over the course of the transaction. In such a case, pay attention to the language being used to make adjustments for the stock price as the stock price may fluctuate over transaction time. The exchange ratio will be x amount of acquirer stock per x amount of target’s equity. In the alternative, a certain dollar amount of acquirer’s shares can be designated for the exchange of acquirer’s shares for target’s shares.

All stock

This is where the acquirer uses all stock as consideration in the transaction. Similar to the above, special care must given to the language to deal with stock price fluctuations.

M&A Deal Structure, Issues, and Other Items > Payment > Items Affecting Purchase Price

In M&A deals you will almost never see a straight up purchase price. There is going to be some item that adjusts the price or the timing.

Additionally and as a tangential issue, this is where the liquidation preference kicks in when it comes time to being paid out. Preferred shareholders will have a liquidation preference. I’ve covered liquidation preferences in detail elsewhere, but it essentially means the amount that preferred will receive before common. It’s an item to keep in mind when looking at the purchase price.

For items affecting purchase price, here are those items and what to look out for.

Post-closing Adjustment

You may see this in the deal provisions. A postclosing adjustment is usually used when there’s a fair amount of time between the deal agreement and the closing. A postclosing adjustment uses financial data, milestones, etc. to adjust the purchase price in a deal.

Working-capital Adjustments

Working-capital is a company’s current assets minus current liabilities. An M&A deal may have a requirement that a company’s working capital is of a certain amount otherwise the purchase price will be subject to an adjustment.

Earn-outs

This is a type of contingent payment where a portion of the purchase price is bound to items after closing (e.g., meeting certain business/operating milestones). For example, the company is acquired for $X million, but 10% of that amount will be paid a year from the date of closing if a milestone is met. Because of the contingent nature of this type of payment, particular care needs to be given to the language in the contract to make sure the conditions are clear.

As mentioned, there can be different kinds of payments. If it’s cash, the earn-out provision is straight-forward. If payment involves the payment of stock, then, as significant time has passed from the time of the principal agreement to the time the earn-out is to be paid, then particular care needs to be paid to the price of the stock and how it fluctuated. In order to protect for wild swings in stock price, a collar can be used that sets an upper bound and lower bound. If the stock price exceeds one of those bounds then an adjustment can be made.

What’s really important here is that after the deal closes, make sure that there you do not breach the principal or ancillary agreements. If you start breaching, the other side will cause issues and that may be with the earn-out that you were expecting.

Holdback

The holdback amount is held in escrow in order to satisfy any payments for indemnification purposes. I covered indemnification above—it’s a contractual agreement that one party pays another for damages or losses.

If there is a problem with the representation and warranties (i.e., there is a breach) the holdback amount will be used to satisfy the damages. This is often used in conjunction with a “basket”, such that a certain amount of dollar amount of damages needs to aggregated before the acquirer can recover for the losses.

A breach would allow for recover up to the holdback amount (i.e., the escrow cap) unless the breach was of a fundamental nature and is a carve-out to the escrow. If that is the case, then the amount to be recovered can exceed the holdback amount. A breach of a fundamental representation would be something on the level of fraud, illegality, or similar big ticket item.

M&A Deal Structure, Issues, and Other Items > Stock Options

The relevant issues regarding stock options and M&A transactions are whether and how the options will have an acceleration of vesting upon the transaction. This may allow for an exercise of options prior to transaction.

Another relevant issue regarding stock options is whether or not the stock options will be assumed by the acquirer. If the transaction is stock-for-stock, and the options are assumed, then the option exercise will be for acquirer’s common stock. There are times when an anti-assignment provision is in the option agreement where this is not allowed. So this is an area to pay attention to.

The treatment of stock options in the M&A context is heavily contract dependent. As you know, stock options go through various classifications and steps over time from unvested options to vested options to exercise. The question is what happens to your options if the M&A event occurs at a particular stage.

Stage 1: Unvested Options

This is one of the areas where what happens is contract dependent.

An unvested option is where you have an option but it subject to reverting back to the company in certain circumstances (you do not have the option outright).

If the M&A event occurs when stock options are unvested then your unvested options can lapse and be canceled or you can be issued a new stock option grant in the new company. It all depends on what the contracts say.

Stage 2: Vested Options

A vested option is where you own the option outright and can exercise as according to the grant and plan documents.

Again, it all depends on the contracts. It is possible here that your vested options are cashed out.

Stage 3: Exercised Options

Exercised options are those options that were vested and properly exercised. When exercised the option holder received company shares. If you have company shares and there is an M&A event you will be treated like any other common shareholder in the transaction and be paid out accordingly.

M&A Deal Structure, Issues, and Other Items > Dissenters’ or Appraisal Rights

Dissenters’ or appraisal rights are when certain shareholders are able to receive fair market value of their shares in an M&A transaction. This will happen when a target shareholder vote was required, the individuals of the target company voted against the transaction and sent notice to the target company with a demand to appraise the fair market value of their shares.

M&A Deal Structure, Issues, and Other Items > Ancillary Agreements

The principal agreement will allude to ancillary agreements. Ancillary agreements are agreements that supplement the principal agreement with further details or are small side agreements to the principal.

Why is this important?

It’s important because even though it may seem that an action does not breach the principal agreement on the face of it, the deal can be jeopardized if an ancillary agreement is breached. So careful attention must be paid to multiple agreements.

M&A Deal Structure, Issues, and Other Items > Playing Defense

Unwanted actions can take place in the M&A corporate world. Hostile takeovers, poison pills, etc. can occur. These exciting and scary terms come into play when an acquirer attempts to take over a target without the target board and management consenting to the transaction.

These defensive measures are more advanced techniques and beyond the scope of this article. I mention them because it is a topic you may be wondering about. And they are items that target company can use for protection.

In a hostile takeover, the acquirer goes around the target board and management team to the target shareholders directly in a situation where the board and management team does not the company to be acquired. The acquirer deals with target shareholders by offering to buy their shares at a certain price (tender offer) or by a proxy fight where shareholder votes are influenced.

Target can attempt to play defense with a number of tools such as staggered boards, certain charter or bylaw provisions, and poison pills.

There are various types of poison pills but essentially it allows shareholders certain rights that, in the case an acquirer obtains a certain X% of the target, that existing target shareholders can purchase more shares of the company at a discounted rate. This dilutes acquirer’s holdings and makes the takeover much more expensive.

M&A Deal Structure, Issues, and Other Items > Securities

Stock is a type of security and thus is subject to securities regulation. This means that unless the stock is registered there must be an appropriate exemption that can be used.

For a broader discussion on securities see this article: https://legalstuff.live/startup-financing-101

This may impact the choice of acquisition structure. If all shareholders are not accredited, then acquirer can use a few tools to get around this issue including using cash instead of stock to pay those shareholders.

M&A Deal Structure, Issues, and Other Items > Tax

Now, everyone’s favourite topic.

Attention must always be given to tax considerations in any transaction.

This is a highly technical and consequential part of M&A deals. I will not go into great detail here as this should all be left up to a qualified accounting team. Nonetheless, some idea of what is going on is key. It’s like going to the doctor. You don’t need to know all of the science behind how a medical decision is made, but having a general understanding helps a ton. You’re able to ask the right questions and make sure everyone’s on the same page.

First, I’ll start by explaining a few concepts and then follow with recommendations and best practices.

Tax-basis

Broadly, this is how much the asset costs. This is adjusted by depreciation. [Depreciation is a mechanism to recover the cost over time as you use the property.]

Forgetting about adjustments and for simplicity purposes for now just consider that tax-basis is the cost. If you buy an asset for $500,000, your tax-basis is $500,000 even if you later sell it for $750,000.

When you sell it for $750,000, you recognize a gain of $250,000 for tax purposes.

Step-up Tax Basis

Step-up basis is where the acquirer’s basis in the asset is the amount paid for it (fair-market value). Thus, in the example above, where you bought an asset for $500,000 and sold the asset for $750,000, the acquirer’s basis in the asset would be “stepped-up” to $750,000.

A step-up basis is advantageous for acquirer versus the acquirer receiving a carry-over basis (as described below). If the acquirer then sells the asset it for $1,000,000 the acquirer would recognize a gain of $250,000 [$1,000,000 sell price minus $750,000 stepped-up basis].

Carry-over Tax Basis

Carry-over basis is where the acquirer’s basis in the asset is the same as seller’s basis. It “carried-over”.

In the example above, a carry-over basis is disadvantageous for acquirer. If acquirer had the same basis as seller (carry-over basis) and acquirer sold the asset for $1,000,000 then acquirer would recognize a gain of $500,000.

The carry-over basis resulted in a $250,000 increase in recognizable gain for acquirer as compared to a step-up basis.

Layers of Tax

General or C-corporations have two layers of tax—a tax at the entity level and then at the shareholder level. Limited liability companies (LLCs) have one layer of tax as tax repercussions pass through the entity layer to the LLC members.

This means that in certain M&A transactions the C-corp/shareholder setup is taxed twice. [Note that the company may be able to use net operating losses to offset gain resulting in no tax.] If the entity level tax is substantial, the amount available for shareholders will significantly lessen.

Tax-Free Reorganizations

Tax-free reorganization is an important tax concept. Certain M&A business combinations are considered tax-free reorganizations.

Now let me preface this from the get-go. “Tax-free reorganizations” does not actually really mean “tax-free” in the way you might think it is. It just means the tax consequence is delayed until the acquirer gets rid of the stock. You can probably think of a better term than “tax-free reorganization” but that might be a difficult thing to change.

So why is there this concept of delaying the tax consequence? When an acquirer pays for stock with cash (for example) outright, there is a substantially clear tax consequence right then and there. But when someone uses stock to pay for stock, essentially the investment is carried over to a different vehicle. In the eyes of the government, this can be beneficial for the economic reasons. And the government wants to promote that.

There are certain conditions that must be met in order for a transaction to be considered a tax-free reorganization.

These reorganizations are named after the particular internal revenue code subsections. Not the most creative, but it works.

Type A Reorganization

The type “A reorganization” applies to statutory mergers. In order to qualify as a tax-free reorganization, at least 40% of consideration from the acquirer to the target shareholders needs to be acquirer’s stock.

[368(a)(1)(A) of Internal Revenue Code]

Type B Reorganization

Acquirer uses as consideration only its voting stock for target company stock and then owns at least 80% of target company’s stock.

[368(a)(1)(B) of Internal Revenue Code]

Type C Reorganization

A type C reorganization is where stock is exchanged for assets. Asset uses its stock as consideration for “all or substantially all” of target’s assets. Target is liquidated and acquirer’s stock then goes to target’s shareholders.

80% of the consideration acquirer uses in the transaction must be of voting stock.

[368(a)(1)(C) of Internal Revenue Code]

Subsection D

Subsection D deals with forward triangular mergers. Remember that’s where acquirer forms a subsidiary and the target merges into subsidiary with subsidiary being the surviving entity.

In order to qualify as a tax-free transaction, acquirer must use acquirer stock of at least 40% of the total consideration paid to target company’s shareholders.

[368(a)(2)(D) of Internal Revenue Code]

Subsection E

Subsection E deals with reverse triangular mergers. Remember that’s where acquirer forms a subsidiary and the target merges into subsidiary with target being the surviving entity.

In order to qualify as a tax-free transaction, acquirer must use acquirer voting stock of at least 80% of the total consideration paid to target company’s shareholders. Additionally, acquirer needs to get control of the target company.

[368(a)(2)(E) of Internal Revenue Code]

Section 351 Exchange (80% Test)

With a 351 exchange, target assets can be exchanged for stock of the acquirer as tax-free (i.e., tax-deferred (see note above)) if after the transaction, target shareholders own 80% or more of acquirer.

Summary of this Article

Going back to the beginning, these are the main points of this article.

Mergers and acquisitions (M&A) are transactions where the ownership of a company is transferred to or combined with another entity. This can be a type of “exit” for the present owners of the organization as they can sell out and leave the organization.

The structure of these deals falls under three categories: asset sale, stock sale, merger (three types: direct/forward, forward triangular, and reverse triangular). For primarily smaller deals and for tax reasons, targets prefer a stock sale and acquirers prefer an asset sale.

However, the favourite mechanism is the reverse triangular merger because (1) target still has the same legal status which helps in continuity for contracts, etc. (2) can squeeze out minority shareholders (3) easier for consent.

All of these deal structures have different requirements, different issues, different consequences and what structure is being used depends on negotiating power of the parties, and peculiars of the companies/transaction.